The best health insurance in Australia relies on personal needs and choices. Medibank, Bupa, HCF, and AHM often have excellent deals.

In Australia, choosing the best health insurance means weighing things like coverage choices, premiums, outpatient care, and extra benefits. Health care is important to Australians because they see it not only as a necessity but also as a key part of keeping their lives safe. The best insurance companies have a variety of plans to meet the wants of all their customers.

Have you searched everywhere for a cheap, comprehensive health insurance plan in Australia? No more searching! You can choose the best health insurance plan with the right knowledge and guidance. This post will help you uncover the finest health insurance carriers in Australia, including the cheapest, without sacrificing coverage. We offer the information you need to find the best health insurance for your needs and budget, whether you are an Australian citizen or permanent resident. Let’s find out how to get Australia’s top health insurance.

Credit: www.insurancebusinessmag.com

Introduction To Health Insurance In Australia

Welcome to the ultimate guide to health insurance in Australia. Whether you are a resident or an expat, understanding and choosing the right health insurance is crucial. This guide will help you navigate the complexities of the Australian healthcare system.

Understanding The Health Insurance Australia System

Australia boasts a unique healthcare system called Medicare. This public program offers basic health services to all Australian citizens and permanent residents. But it has its limits. To get more coverage, many Australians buy private health insurance. This can cover higher-cost services and private hospital rooms.

Private health insurance also means that certain procedures have shorter wait times. Private health insurance is divided into two types: hospital policies, which cover in-hospital treatment, and general treatment policies, which cover services such as dental and physiotherapy.

The Importance Of Health Insurance For Australians And Expats

Health insurance is more than just a safety net. It is essential for accessing broader health services in Australia. Without it, hefty bills can follow unexpected medical events.

- Immediate access to healthcare without the long public system queues.

- Choice of selecting your preferred doctor or specialist.

- Peace of mind knowing you have financial protection in case of emergencies.

For expats, health insurance is often a visa requirement. It also assures healthcare coverage that meets or exceeds the public system.

Criteria To Consider When Choosing Health Insurance

Selecting the perfect health insurance in Australia involves careful thought and consideration. Individuals must evaluate their personal needs, explore coverage options, and weigh costs against benefits. Below, delve into key factors to ensure you choose the best-suited health insurance for your lifestyle.

Assessing Your Health Insurance Needs

Understanding your health needs is the first step to finding the ideal policy. Take into account your age, health history, lifestyle, and any regular medical services you require. Pregnant women, for example, might prioritize maternity coverage. Those with glasses might seek policies with optical benefits.

Comparison Of Coverage Options: Hospital, General Treatment, And Extras

- Hospital Cover: Pays for part or all of the costs associated with hospital treatment. Look for policies covering a wide range of services.

- General Treatment: Covers non-hospital medical services like dental and physiotherapy. Confirm which services are included.

- Extras: These are additional benefits beyond hospital and general treatment, such as gym memberships. Decide what extras are necessary for you.

Evaluating Cost Vs. Benefits: Premiums, Out-of-pocket Expenses, And Rebates

| Cost Factor | Consideration |

|---|---|

| Premiums | Monthly fee for your health insurance. Choose a plan you can afford without sacrificing needed coverage. |

| Out-of-Pocket Expenses | Costs are not covered by insurance. Lower premiums often mean higher out-of-pocket expenses. |

| Rebates | Government rebates can lower premium costs. Check your eligibility. |

Assessing premiums, out-of-pocket expenses, and rebates helps balance your budget with your healthcare needs. Lower premiums might mean higher out-of-pocket costs later. Always consider the long-term financial impact of your health insurance choice.

Top Health Insurance Providers In Australia Reviewed

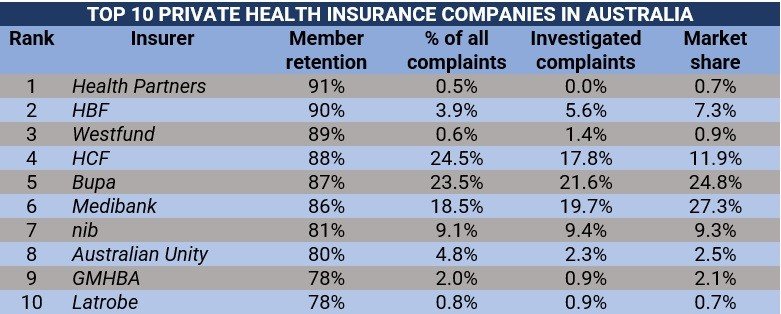

Choosing the right health insurance is quite difficult. There are several top-tier health insurance companies in Australia. Each provider offers a unique advantage. This review helps you understand and compare these options.

HCF, Bupa, and Medibank stand out among Australia’s health insurance providers. Let’s delve into their offerings.

Here is a comparison table between three giant health insurance companies:

| Provider | Coverage Options | Customer Satisfaction | Price Point |

|---|---|---|---|

| HCF | Comprehensive plans | High ratings | Competitive |

| Bupa | Tailored packages | Strong support network | Flexible |

| Medibank | Wide coverage range | Good feedback | Varied |

Another listing of other insurance companies:

Aside from these leaders, other notable companies provide quality health insurance in Australia. These include NIB, Australian Unity, and GMHBA.

Different life stages call for different health insurance needs. Individuals may prefer low-cost options with essential coverage. Families require a plan with broader benefits. Single parents look for a balance between affordability and comprehensive coverage for themselves and their children.

- Individual Plans: Focus on affordability and key services.

- Family Plans: Include extras like dental and optical.

- Single Parent Plans: Offer discounts and special benefits for kids.

Expats and international citizens may need health insurance that covers them both in Australia and abroad. Specialized insurers like Cigna Global and Allianz cater to their unique requirements.

List of Specialized Insurance Options

- Cigna Global: Global coverage and flexible plans.

- Allianz Care: Comprehensive international health insurance.

- Bupa Global: has a wide-reaching network and premium services.

Credit: www.prnewswire.com

Choosing The Best Health Insurance For Different Demographics

Choosing the Best Health Insurance for Different Demographics entails a thorough look at age, health needs, and lifestyle. With a vast array of plans available, picking the right one ensures safety and peace of mind. Whether you are a young single, part of a growing family, or a senior, the perfect health insurance plan tailored to your demographic exists. Let’s explore the options to help you make an informed decision.

Health Insurance For Young Singles And Couples

Young singles and couples often need budget-friendly and flexible health insurance. Coverage for basic healthcare services, dental check-ups, and emergency services is essential. Look for plans with low premiums and fitness-related incentives.

Tailored Health Insurance Choices For Families And Seniors

Families require plans covering children’s health needs and prenatal care. Seniors should consider coverage for chronic conditions, prescription medications, and specialized care. Look for family packages and senior discounts.

| Demographic | Key Features | Recommended Plan |

|---|---|---|

| Families | Child immunisations, dental | Family Care Package |

| Seniors | Joint care, heart check-ups | Senior Vital Plan |

Selecting Health Insurance For Temporary Residents And Overseas Visitors

For those in Australia temporarily, consider health coverage for the duration of your stay. Plans should include emergency services and immediate medical attention. Overseas visitor plans fit short-term needs perfectly.

- Emergency medical coverage is a must.

- Plans should be renewable or extendable.

- Consider coverage for sports and activities.

Expert And Consumer Opinions On Health Insurance Picks

Choosing the right health insurance can be daunting. Opinions from industry experts and consumers help cut through the jargon. Here’s a guide to the top health insurance picks in Australia.

Industry Awards And Ratings: Canstar And Insurance Business America Perspectives

Industry awards and ratings provide a benchmark for excellence. Canstar annually rates Australian health insurers on features and value. Insurers covet these ratings for credibility. Insurance Business America offers insights into financial stability and customer satisfaction levels.

Example of a simple table for display of award winners

| Award Category | Winner |

|---|---|

| Outstanding Value Health Insurance | Provider A |

| Outstanding Value Hospital Cover | Provider B |

| Outstanding Value Extras Cover | Provider C |

Consumer Reviews And Testimonials

Consumer opinions shape perspectives on service quality. Websites like ProductReview.com.au showcase real user experiences. These testimonials highlight the pros and cons of actual policyholders.

Unordered list example for key consumer-reported pros and cons

- Quick claims processing

- Transparent coverage information

- Helpful customer service

- Pricing concerns

- Limited hospital network access

Expert Recommendations For International Coverage And Value For Money

International travellers need broad coverage. Experts recommend insurers that provide global benefits. These benefits ensure medical support beyond Australian borders.

An example of expert recommendations in bullet-point format

- Comprehensive global network

- Affordable premiums and extensive coverage

- Tailored plans for international students and ex-pats

For value for money, experts compare plans against benefits. They seek options with a balance of cost and coverage.

Ordered list examples for top-value providers

- Best for families

- Ideal for singles and young adults

- Competitive for seniors

Final Advice And Considerations

Choosing the right health insurance in Australia is not just about finding the lowest premium. It’s about understanding your needs and how different plans can meet them. Below are crucial tips and tools to guide you through this process.

Navigating Health Insurance Policies: The Fine Print

Reading policy documents is crucial. Look for exclusions, waiting periods, and benefit limits. These details affect your coverage and out-of-pocket costs. It’s about knowing what you’re buying into.

- Exclusions: Services are not covered.

- Waiting Periods: Time before you can claim benefits.

- Benefit Limits: Maximum amounts payable.

How To Switch Or Upgrade Your Health Insurance Plan

You can change insurers or policies to better suit your needs. Notify your current provider and review any waiting periods. Often, credits from previous waiting periods transfer to your new policy.

- Assess your current health needs.

- Compare the new plans thoroughly.

- Contact the insurer to switch or upgrade.

Utilizing Health Insurance Comparison Tools And Broker Services

Use online tools to compare plans. They save time and provide a broad market overview. Brokers offer personalized advice. They can find deals that are not always available publicly.

| Comparison Tool Benefits | Broker Service Benefits |

|---|---|

| Wide range of options | Expert-tailored advice |

| Quick side-by-side comparisons | Access to exclusive offers |

| Filter features based on need | Assistance with paperwork |

Credit: www.cnn.com

Frequently Asked Questions On Which Health Insurance Is Best In Australia

What Is The Best Health Insurance For International Citizens In Australia?

The best health insurance for international citizens in Australia is the Cigna Global Medical Insurance plan.

What Is The Most Reliable Insurance Company In Australia?

The most reliable insurance company in Australia is often considered to be HCF, known for its customer satisfaction and comprehensive coverage.

Can Us Citizens Get Healthcare In Australia?

Yes, US citizens can access healthcare in Australia, but they must pay for services or have private health insurance.

How Much Is Health Insurance In Australia Per Month?

The average monthly cost of health insurance in Australia varies but can range from AUD 80 to AUD 110.

Conclusion

Navigating the maze of health insurance options can be daunting. Yet, finding the right coverage in Australia is critical. Remember, the best policy depends on your individual health needs and budget. Always compare plans, consider coverage benefits, and read the fine print.

Aim for peace of mind knowing your health is safeguarded. Choose wisely to ensure your well-being is in capable hands.