Doordash has become increasingly popular as a convenient way to order food and have it delivered to your doorstep. However, many wonder- Does Doordash Increase Car Insurance?

Doordash may increase car insurance. Dashers must maintain their auto insurance as per local laws. Doordash provides third-party auto liability insurance for Dashers. It covers accidents during the Delivery Service period.

In this article, I explore whether Doordash increases car insurance. I also examine Doordash’s measures to ensure its drivers are adequately covered. Understanding Doordash’s impact on car insurance is important for drivers and customers.

So, let’s dive into the details and clearly understand how car insurance works for Doordash drivers.

What Is Doordash?

Doordash is a popular food delivery service that connects customers with local restaurants. DoorDash drivers, or Dashers, use their vehicles to pick up orders and deliver them to customers’ doorsteps.

How Does Car Insurance Work?

Car insurance is a protection plan that provides coverage in the event of an accident or damage to the insured vehicle. Also, it helps cover the costs of repairs, medical expenses, and liability claims.

Does Doordash Increase Car Insurance?

Yes, driving for a food delivery service like DoorDash can potentially increase your car insurance premiums. Here’s why:

- Business Use of Vehicle: Insurance companies usually classify food delivery as a business use of your vehicle. Personal car insurance policies usually don’t cover business use. So, you might need to get a commercial policy or add a business use endorsement to your current policy.

- Higher Risk: Delivery drivers drive a lot during busy times. This can make accidents more likely. Insurance companies may charge higher premiums to account for this increased risk.

- Requirement by DoorDash: DoorDash requires its drivers to maintain their insurance. However, they also provide some additional coverage while you are on a delivery. Understanding the limits of this coverage and how it interacts with your insurance is essential.

- Informing Your Insurance Company: If you begin working for DoorDash and don’t tell your insurance company, you might break your policy terms. This could lead to a denial of coverage if you are in an accident while delivering.

However, it’s always advisable to speak with your insurance agent. Understand how delivering for DoorDash might affect your insurance coverage and costs. They can provide specific advice based on your policy and situation.

Impact Of Doordash On Car Insurance Rates

When working as a Doordash driver, it is vital to consider its impact on your car insurance rates. As a Doordash driver, you are using your car for commercial purposes. This might require changes to your insurance policy.

Commercial Use Vs Personal Use Insurance Rates

Doordash drivers need to have the right insurance. Also, your insurance type affects how Doordash affects your car insurance rates. Personal use insurance is usually cheaper than commercial use insurance.

But, as a Doordash driver, you use your car for business. So, you might need to change your insurance policy. Commercial use car insurance costs more because driving for work is riskier.

Driving a lot and doing deliveries can lead to accidents. Insurance companies know this and charge higher premiums. Doordash drivers need to know the difference between personal and commercial insurance rates. They should change their policy if needed.

Insurance Requirements For Doordash Drivers

If you work as a Doordash driver, you must follow Doordash’s rules and local insurance laws. According to Doordash’s agreement, you need to have your primary auto insurance that meets the minimum limits set by the local laws.

This means you need your own insurance and third-party auto liability insurance from Doordash. Having your own insurance ensures you meet the legal requirements and have enough coverage if there’s an accident.

If you don’t have your own insurance, you won’t be covered by Doordash’s insurance and could face financial problems. So, looking at your current insurance policy and talking to your insurance company to ensure you follow Doordash’s rules is essential.

How Do Insurance Companies View Doordash?

Insurance companies see Doordash and similar delivery services as using a vehicle for business. They consider the extra risks of driving for work and adjust the premiums. When you tell your insurance company you work for Doordash, they might change your policy from personal to business use. This could mean your rates change.

However, not all insurance companies cover Doordash and similar services, so drivers have fewer options. So, it’s really important to talk to your insurance company and determine your options for getting the right coverage for your Doordash work. By being proactive and informed, you can ensure you have the coverage you need at a fair price.

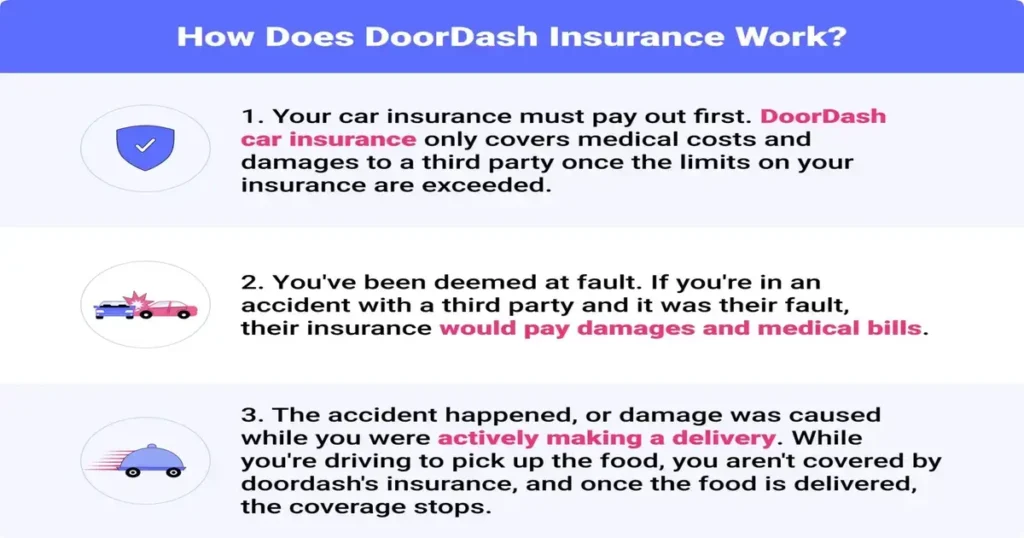

Insurance Coverage Gaps With Doordash

Doordash provides auto liability insurance, but it may not cover everything. Certain damages and expenses may not be covered. Examples include comprehensive or collision coverage and medical expenses for accidents.

In addition, Doordash’s coverage may have deductibles or limits, so you might have to pay for some costs. Doordash drivers should check their current insurance policy to fill in these gaps. They should also consider getting extra coverage for delivery services.

Rideshare or commercial use insurance might cover these gaps and protect you in any situation. By understanding the gaps in insurance coverage, you can make smart choices to keep yourself and your vehicle safe while working for Doordash.

Tips For Doordash Drivers To Manage Insurance Costs

If you work for Doordash as a driver, you must know how your delivery job might change your car insurance. Doordash gives you insurance for accidents that happen while you’re making deliveries.

However, it’s still vital for you to have your insurance with the minimum coverage. Also, this can help protect you and cover any gaps in Doordash’s coverage.

Notify Your Insurance Company

Tell your insurance company about your deliveries to ensure you have the right insurance coverage as a Doordash driver. Letting them know about your work with Doordash will help them assess your insurance needs and make any necessary changes to your policy. If you don’t inform your insurance company about your delivery work, they might deny your claims if you have an accident.

Consider Rideshare Insurance

Check if your insurance covers rideshare activities. Make sure your policy includes this coverage. Rideshare insurance fills gaps between your personal auto insurance and Doordash’s coverage. Switch companies or add an endorsement if your insurance doesn’t cover rideshare.

Compare Insurance Providers

To manage your insurance costs as a Doordash driver, compare different insurance providers. Each company has different rates and coverage options.

So, shopping around and finding the best policy for your needs and budget is essential. Look for providers with competitive rates for delivery drivers. Also, consider any extra benefits they offer, like roadside assistance or accident forgiveness.

Maintain A Safe Driving Record

Maintaining a safe driving record is one of the most effective ways to manage insurance costs. To keep your insurance costs low, drive safely, obey traffic rules, and avoid risky behaviour. Having a clean driving record saves you money and keeps you and others safe.

As a Doordash driver, you can manage your insurance costs by following these tips:

- Notify your insurance company.

- Consider rideshare insurance.

- Compare different providers.

- Maintain a safe driving record.

By taking these steps, you can make sure you have the right coverage and avoid any financial problems.

Frequently Asked Questions On Does Doordash Increase Car Insurance

Does Doordash Add To Car Insurance?

DoorDash offers auto liability insurance to Dashers who have accidents while delivering. Dashers must also have their own primary auto insurance with minimum limits set by local laws.

Does Being A Dasher Make Your Insurance Go Up?

No, being a Dasher does not automatically make your insurance go up. However, as a Dasher, you need to have personal auto insurance that covers the commercial use of your car. Business use of a car typically has higher rates due to increased risks.

Maintaining the necessary insurance coverage as required by local insurance laws is essential.

Do I Need To Change My Insurance For Doordash?

Yes, you need to change your insurance for DoorDash. As an independent contractor, you must maintain your own insurance that covers the commercial use of your car. If you fail to do so, DoorDash’s coverage may not apply.

Do You Have To Tell Your Insurance Company You Do Doordash?

Yes, you should inform your insurance company if you do DoorDash. Failure to disclose this information may result in your insurance claims being denied in the event of an accident. However, checking if your current policy covers rideshare or delivery services is essential. If it doesn’t, explore obtaining additional coverage.

Wrap Up

DoorDash provides insurance for Dashers involved in accidents while delivering. Dashers must also have their insurance to follow the law. It’s vital because working for DoorDash means using a car for work, which usually costs more for insurance because it’s riskier.

Dashers need to tell their insurance company about their work to make sure they’re covered if there’s an accident. Also, this will help prevent insurance claims from being denied.

Lastly, I request you watch the video below to learn more.

protector 3 plus пептиды

[url=https://protector3-plus.ru/]https://www.protector3-plus.ru[/url]